CLICK LINK BELOW

http://epaper.

ORYZA REPORT AUTHORED BY ME.

WITH “LEVY RICE”

REDUCED TO 25%-- GOVT SAVES Rs 24000 CRORES PER ANNUM

================================================

ABOUT 10 MILLION TONS OF EXTRA MARKET AVAILABLITY WILL SOFTEN RICE

PRICES; INCENTIVIZE EXPORTS.

Food Ministry has recently

directed major paddy growing states of non –basmati rice to limit “levy” to

maximum of 25% from earlier notified percentage of 30%-75%. In nut-shell,

quantum of rice procured on Government account will be restricted. This indeed is a very progressive step for surplus

availability of rice in the market and consistent with WTO obligations of

lowering public stock holdings and reduction in food subsidies. Though

Government may be taking hard position at WTO, it appears to work for WTO

compliance.

This levy reduction order will

make open market rice cheaper; food inflation will be moderated; quality

improvisation will take place; exports prices will be lower and non- basmati

rice export will be incentivized. Pressure

on FCI and state governments for creating storage space will lessen.

In Kharif marketing season (KMS)

commencing 1st October 2014 and till 21.07.2014, FCI procured 31

million tons of rice (fig 1) in two

different modes; 11 million tons is sourced from Panjab/ Haryana as custom

milled rice (CMR); balance 20 million tons is purchased as “levy rice” from

other states. Under CMR, paddy is procured by FCI/state

government agencies from farmers at MSP and thereafter processed into rice by

FCI making payment of tolling charges to millers. Under levy rice system,

farmers sell paddy to millers at MSP, and then millers sell a fixed percentage

(now directed at 25%) as levy to states as per predetermined prices of rice.

FIG 1

Less procurement of

10 million tons

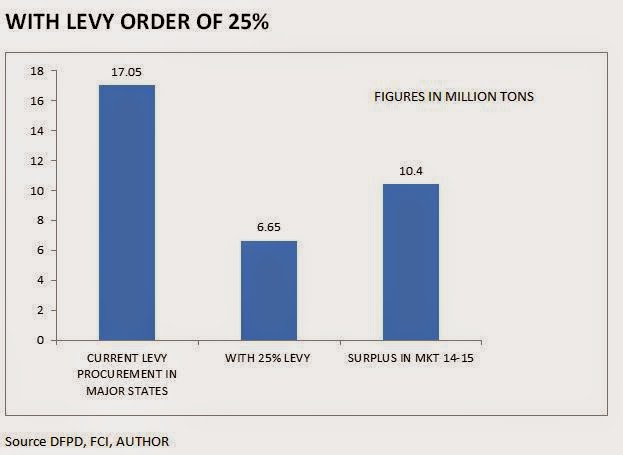

This existing system (CMR+

30%-75%levy) has led to over procurement, overstocking, wastage/deterioration,

excessive involvement of central funds, higher subsidies. Reduction in levy to 25% will correct the systemic

deficiencies. Fig 2 ,

shows “excess” availability of about 10 million tons in the market when

25% levy orders are enforced. One can surmise that Food Ministry is now

targeting at a procurement of about 21-22 million tons in 2014-15, from 31

million tons in 2013-14. At acquisition cost Rs 24000/metric ton (FCI website)—procurement

of 31 million tons amounts to whopping of Rs 74400 crores. The corresponding savings by reduced procurement of 10million tons will

be Rs. 24000 crores.

FIG 2

Concerns of small millers

Since Chhattisgarh, AP, Orissa

and Telengana are the most affected regions, small rice millers in these states

may protest against such directions because they are denied assured purchases

by the states. Small units will now have to undertake marketing directly for

whatever quality they process or sell through exporters or undertake export

directly. Millers with outdated processing technology may have to modernise for

meeting market expectations/specifications. As the intention is to eventually abolish the

levy system, Centre may have to get over the resistance exerted by these

stakeholders.

Another argument that farmers will be denied

MSP if they deal with private millers, carries little merit. India produces

about 160 mill tons of paddy (eq to 106mill tons of rice), while only 47

million tons of paddy (eq. to 31 milled rice) is handled by FCI/government

agencies. The fact being (160-47) =113 million tons of paddy is bargained

directly by farmers. Thus debate on this issue is not maintainable. Should in any year there is widespread

procurement of paddy below MSP, Centre can authorise an ad-hoc intervention to

stabilise the price to MSP as is done in the case of maize.

Exports eased

India’s 40% of non-basmati rice

(about 2.5 million tons) is shipped out of Andhra Pradesh’s (AP) port of

Kakinada. AP requires evidence of servicing levy (currently 75%) of “release certificates”

(RC) from their Civil Supplies Corporation before authorising export shipments.

In June-July2014, exporters of

Non-Basmati rice could not obtain such “Release Certificate” as AP government

was not willing to accept compliance of levy obligations done by millers in the

newly created state of Telengana. This resulted into loss/ loss of profit owing

to purchasing expensive rice from Chhattisgarh and payment of demurrage on the

vessels. Buyers either deferred future business or diverted to Thailand. By mitigation

of levy to 25%, such instances may be rare.

Threat of

Thailand or Vietnam lowering their quotes of non- basmati rice and affecting Indian

exports too gets minimized. Indian rice prices may soon be seen in bearish mode

because the sentiment of extra supplies in the near future will prevail in the

market.

FIG 3—COMPILATION DATA OF FIG 2

PERCENTAGE OF LEVY

RICE TO BE DELIVERED IN STATES/UTs UNDER LEVY ORDERS DURING KMS 2011-12.

|

Sl.

No.

|

Name of the

State/UTs

|

Category |

Quantum

of Levy

|

|

1.

|

2.

|

3.

|

4.

|

|

1.

|

ANDHRA PRADESH

|

MILLERS/DEALERS

|

75%

|

|

2.

|

ASSAM

|

MILLERS

|

50%

|

|

3.

|

BIHAR

|

MILLERS/DEALERS

|

50%.

|

|

4.

|

CHHATISGARH

|

MILLERS/DEALERS

|

50%

|

|

5.

|

DELHI

|

MILLERS/DEALERS

|

75%

|

|

6.

|

GUJARAT

|

MILLERS

|

50%

|

|

7.

|

HARYANA

|

MILLERS/DEALERS

|

75%

|

|

8.

|

HIMACHAL PRADESH

|

MILLERS/DEALERS

|

50%

|

|

9.

|

JAMMU & KASHMIR

|

MILLERS/DEALERS

|

50%

|

|

10.

|

JHARKHAND

|

MILLERS/DEALERS

|

50%

|

|

11.

|

KARNATAKA

|

MILLERS/DEALERS

|

33.33%

|

|

12.

|

MADHYA PRADESH

|

MILLERS/DEALERS

|

30%

|

|

13.

|

MAHARASHTRA

|

MILLERS/DEALERS

|

30%

|

|

14.

|

NAGALAND

|

MILLERS/DEALERS

|

50%

|

|

15.

|

ORISSA

|

MILLERS

|

75%

|

|

16

|

PUNJAB

|

MILLERS/DEALERS

|

75%

|

|

17.

|

RAJASTHAN

|

MILLERS/DEALERS

|

50%

|

|

18.

|

TAMIL NADU

|

MILLERS/DEALERS

|

30%

|

|

19.

|

UTTAR PRADESH

|

MILLERS/DEALERS

|

60%

|

|

20.

|

UTTARAKHAND

|

MILLERS/DEALERS

|

75%

|

|

21.

|

WEST BENGAL

|

MILLERS/Wholesalers

|

50%

|

|

22.

|

CHANDIGARH

|

MILLERS/DEALERSMMM

|

75%

|

|

23

|

PUDUCHERRY

|

MILLERS/DEALERS

|

50%

|

*******

PERCENTAGE OF LEVY RICE TO BE DELIVERED IN STATES/UTs UNDER LEVY ORDERS

DURING KMS 2012-13.

|

Sl.

No.

|

Name of the

State/UTs

|

Category |

Quantum

of Levy

|

|

1.

|

2.

|

3.

|

4.

|

|

1.

|

ANDHRA PRADESH

|

MILLERS/DEALERS

|

75%

|

|

2.

|

ASSAM

|

MILLERS

|

50%

|

|

3.

|

BIHAR

|

MILLERS/DEALERS

|

50%.

|

|

4.

|

CHHATISGARH

|

MILLERS/DEALERS

|

50%

|

|

5.

|

DELHI

|

MILLERS/DEALERS

|

75%

|

|

6.

|

GUJARAT

|

MILLERS

|

50%

|

|

7.

|

HARYANA

|

MILLERS/DEALERS

|

75%

|

|

8.

|

HIMACHAL PRADESH

|

MILLERS/DEALERS

|

50%

|

|

9.

|

JAMMU & KASHMIR

|

MILLERS/DEALERS

|

50%

|

|

10.

|

JHARKHAND

|

MILLERS/DEALERS

|

50%

|

|

11.

|

KARNATAKA

|

MILLERS/DEALERS

|

33.33%

|

|

12.

|

MADHYA PRADESH

|

MILLERS/DEALERS

|

30%

|

|

13.

|

MAHARASHTRA

|

MILLERS/DEALERS

|

30%

|

|

14.

|

NAGALAND

|

MILLERS/DEALERS

|

50%

|

|

15.

|

ORISSA

|

MILLERS

|

75%

|

|

16

|

PUNJAB

|

MILLERS/DEALERS

|

75%

|

|

17.

|

RAJASTHAN

|

MILLERS/DEALERS

|

50%

|

|

18.

|

TAMIL NADU

|

MILLERS/DEALERS

|

30%

|

|

19.

|

UTTAR PRADESH

|

MILLERS/DEALERS

|

60%

|

|

20.

|

UTTARAKHAND

|

MILLERS/DEALERS

|

75%

|

|

21.

|

WEST BENGAL

|

MILLERS/Wholesalers

|

50%

|

|

22.

|

CHANDIGARH

|

MILLERS/DEALERSMMM

|

75%

|

|

23

|

PUDUCHERRY

|

MILLERS/DEALERS

|

50%

|

*******

So informative sir...thank you

ReplyDelete