HLC REPORT ON FCI—WELL DIAGNOSED, STILL NEEDS BETTER PRESCRIPTION.

OVERHAULING NFSA WILL ALSO RESOLVE WTO SUBSIDY CONTROVERSIES

TEJINDER NARANG

The report of High Level

Committee (HLC) for restructuring of FCI, demolishes some of the myths that

have perpetuated in the national psyche.

The common perception that farmers are enormously benefitting by MSP

procurement of wheat and rice by Government agencies is negated by the HLC observation

(determined basis 70th NSSO--National Sample Survey Office) that

only 5.8% agricultural households are currently beneficiary from this system.

It inter-alia implies that FCI has outlived its procurement related utility and

requires resurrection.

Operational efficiency of FCI is

“diseconomy of scales” -- that with rising volumes of procurement and

distribution, costs are ascending and not descending. Cost of handling wheat is 61% and rice is 40%

of MSP in 2014-15 (average about 50%) as against 48% and 28% (average 38%)

respectively in 2009-10. The leakage

percentage of grains of about 47% through PDS is again evidenced.

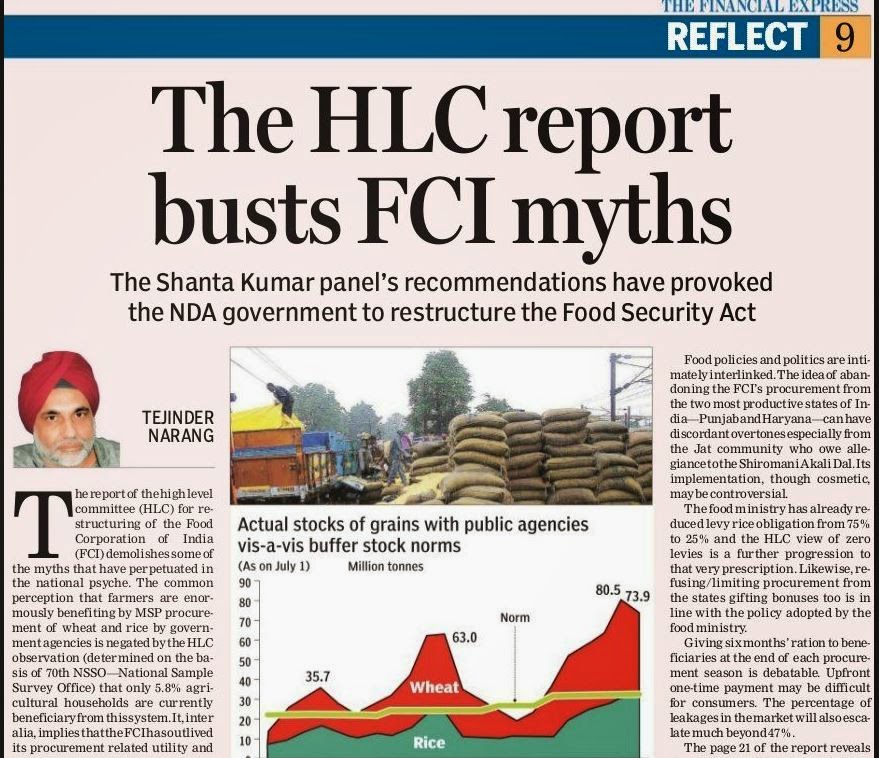

The constraints in the quantum

and quality of storage are well high- lighted. Hoarding of the grains far in excess of buffer

norms (graphic) either due to imprudent policies or inaction or missing export

opportunities has blocked thousands of crores every year, leading to wastage

and high inflation. These conclusions are

supported by robust data. HLC’s advice in some cases is extremely critical,

others cosmetic and some are missing.

CRITICAL VIEWS

HLC recommends shelving of the

National Food Security Act (NFSA) of 2013 in States where its implementation

has yet to commence; reduce coverage to 40% of population to stem the tide of

climbing subsidies (see graphic) and introduce income transfer mode through Jan

Dhan Yojna. Mr Shanta Kumar, Chairman HLC briefed media that BJP’s endorsement

to NFSA in UPA’s regime was driven by politics of “vote convenience” prior to

General Elections. 90% subsidy on 5kg

grains per person per month for 67% of population under NFSA, will amplify PDS

diversions (beyond 47%), for which FCI will continue to be blamed. If NFSA is

allowed to continue, FCI will become a bottomless pit of subsidies because MSP

will be revised upward annually and release price will remain unchanged at

Rs3/2/1 formula.

The report profoundly provokes NDA to overhaul frame work of NFSA.

Savings in handling cost combined with reduction in mandi taxes etc. can

significantly reduce subsidies. Contentious WTO subventions can be set right by

reinventing NFSA.

Concern of HLC on high statutory

and arbitrary levies (mandi- taxes etc.) by the states, ranging 3.6%

(Rajasthan) to 14.5% (Panjab) is also crucial for levelling out market prices

and for active participation of private sector. This is extremely challenging

for the Union government till such time GST issue remains unresolved. How

state Governments/ Panjab Government and BJP ally SAD (Shrimoni Akali Dal) will

react at political level need to be watched.

COSMETIC SUGGESTIONS.

Another view of HLC is to let the

Indian states, which are adept in wheat and paddy procurement –like Punjab Haryana,

Madhya Pradesh, Andhra Pradesh, Chhattisgarh and Odisha undertake purchasing operation

through their own nominated agencies. In

2014-15, FCI share in wheat and paddy procurement is respectively 12.61% and

1.41% (FCI website). The rest of the acquisition is done by State Government

Agencies (SGAs). FCI has, thus,

substantially exited itself out of direct procurement and moved over to

procurement by SGAs. The committee thus

endorses the direction already in practice and gives a cosmetic touch to the

existing policy profile.

Furthermore, HLC suggests that FCI may activate itself in states like

Eastern Uttar Pradesh, Bihar, and West-Bengal, Assam etc. that is contrary to

the process of mitigation of FCI’s direct engagement. When the report maintains that FCI’s

procurement system has outlived its utility, then to replicate the same scheme

for marginal farmers in such areas is contradiction to the conclusion that MSP

benefits to a minuscule percentage of farmers.

Food policies and politics are

intimately interlinked. The idea of abandoning FCI’s procurement from the two

most productive states of India—Panjab and Haryana –can have discordant

overtones especially from the Jat community who owe allegiance to SAD. Its

implementation, though cosmetic, may be controversial.

Food Ministry has already reduced

levy rice obligation from 75% to 25% and HLC view of zero levies is a further

progression to that very prescription. Likewise refusing/limiting procurement

from the states gifting bonuses too is in line with the policy adopted by Food

Ministry.

Giving 6 months ration to

beneficiaries at the end of each procurement season is debatable. Upfront onetime

payment may be difficult for consumers. Percentage of leakages in the market will

also escalate much beyond 47%.

MISSING POINTS

Page 21 of the report reveals

that FCI will buy rice only from the state governments. Millers will be totally

excluded. The onus of any mismanagement of conversion of paddy into rice

through millers devolves upon SGAs. FCI may be out of the noose of

negligence—but it amounts to shifting the problem from the FCI to SGAs.

Financing of paddy operation by the Government agencies should have been

dispensed and direct rice procurement would have been the right step forward.

There could be procedural issues in arriving at the rice price---but that is

what is missing in the report.

The report does mention of lack of alertness

and bureaucratic dithering in undertaking grain exports from FCI stocks.

However it could have given some guidance on the trigger points on this issue.

Just as essentiality of imports is activated once stocks fall below buffer

norms, what should be the “excess”- when stocks exceed the buffer limits for

initiating exports on the basis of MSP plus freight costs and handling expenses

at ports or any other formula? Of course such an “excess” would have accounted

for the domestic necessities. This could

have strengthened hands of the Food and Commerce Ministry for exploiting the

niche opportunities in international trade with extremely short time horizons.

HLC has not commented upon the

trifurcation of FCI in three distinct agencies—procurement, distribution and

storage companies as suggested by the Prime Minister during election campaign.

Another step that will transform FCI functioning will be the least or minimal

usage of gunny or PP bags so that modern silo/hopper wagons system is

introduced and handling shifts to

“machine back” from “human back” to which HLC has referred. Now let us watch to

what extent Food Ministry/ PMO /states accept the wisdom of HLC.